The Dhaka Times Desk We have no idea about tin registration. And so we sit with our arms and legs folded because we think it is difficult. But e-TIN registration is very easy. Learn how to do this.

![E-TIN Registration Is Very Easy: Know How [Tutorial] 1 E TIN-0](https://thedhakatimes.com/wp-content/uploads/2015/04/E-TIN-0-600x360.jpg)

As a good citizen of the country, we have many responsibilities. One of the main responsibilities is paying income tax. Earlier paying income tax was a lot of hassle. With the advent of information technology, the country's income tax certificate issuance system has also changed. Tax Identification Number we call TIN. Now there is no more trouble to get that tin. To facilitate this the National Board of Revenue (NBR) has introduced the e-TIN system. Now all the work will be done instantly at home through internet. All the work can be done with a few clicks on the website.

How to register online:

Today's tutorial shows you how to register for TIN online. First you in this link must be clicked. After that the page that will be launched will ask for information such as user name, password, email id, phone number etc. After filling the information correctly, the capture should be given. All completed then click on registration button. You will see an activation code on your phone shortly. Now enter that code online. Now log in and fill the TIN registration form.

Those who have old 10-digit numbers can also get new 12-digit numbers by clicking on the re-registration tab.

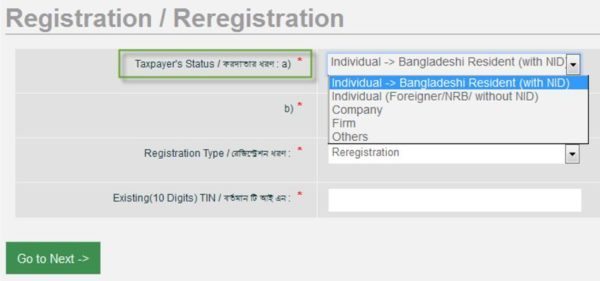

Determination of type of taxpayer:

Type of taxpayer should be selected from option 'A'. This option has 5 options.

Bangladesh Taxpayer (Individual -> Bangladeshi Resident):

All taxpayers who are Bangladeshis, who have voter ID card. Besides, those whose main source of income is personal arrangement, salary, professional, rent etc. should select this option.

![E-TIN Registration Made Easy: Know How [Tutorial] 2 E TIN-2](https://thedhakatimes.com/wp-content/uploads/2015/04/E-TIN-2-600x183.jpg)

On the other hand, a taxpayer can select 'major' or 'minor' from option 'B'. Taxpayers whose age is more than 18 years, taxpayers who are 'major' and taxpayers who are below 18 years of age should click on 'minor' option.

Registration Type:

A taxpayer has to select the type of registration from these options. Here, however, there are two options, a new registration and two old registrations.

How to re-registration:

Taxpayers who are currently in 10 digit TIN must select 'Re-Registration' option to get 12 digit TIN online.

How to make new registration:

Tax payers who do not have any old TIN must select 'new registration' option to get 12 digit TIN online.

Main Source of Income:

In this option a tax payer can select the main part of his income. It has 4 options.

Services: Salary is the main source of income of taxpayers. They have to select 'service' option.

![E-TIN Registration Made Easy: Know How [Tutorial] 3 E TIN-4](https://thedhakatimes.com/wp-content/uploads/2015/04/E-TIN-4-600x190.jpg)

Occupation: All taxpayers whose main source of income is professional such as lawyers, doctors, engineers should select the 'profession' option.

Business: Taxpayers whose main source of income is business should select 'business' option.

Others: All taxpayers whose main source of income is neither service, profession or business should select the 'other' option.

The correct source of income should be selected from these options in the form. If you select it, two options 'Service Location and Type of Employer' will appear.

Workplace: In the 'Service Location' option, all the districts of the country i.e. 64 districts can be found in list form. From there the place of work of the taxpayer should be selected.

![E-TIN Registration Made Easy: Know How [Tutorial] 4 E TIN-6](https://thedhakatimes.com/wp-content/uploads/2015/04/E-TIN-6-600x359.jpg)

Action Type: From the 'Employer Type' option, the type of work of the taxpayer should be determined. For example, if you work in a bank, you have to select the 'bank' option. Then click on 'Go to Next' button.

General information to know:

After entering this option all the details of the taxpayer have to be provided. Like Taxpayer Name, National Identification Number, Date of Birth of Taxpayer etc. This information must be given according to the national identity card of the taxpayer.

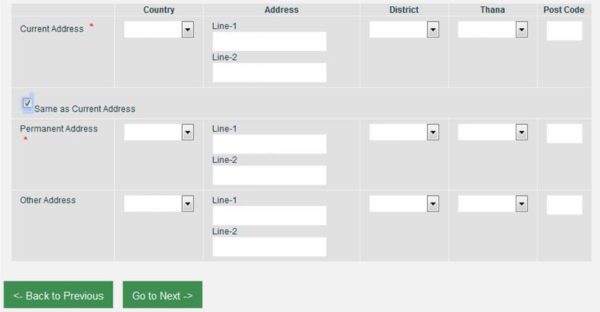

Address Information:

In this section, a taxpayer has to give correct address, current address, permanent address and any other address if desired. In this case the taxpayer must provide the current address and district name. However, the taxpayer can also provide the police station name and post code if he wishes. If current and permanent address are same then only current address should be given. In that case you need to click on 'same as current address' check box. But taxpayer can give office or any other address if he wants. Click on the 'go to next' button to go to the next step when 'Address Information' is provided.

Last words:

This option will check whether the information filled by a taxpayer is correct or not. You can change any information if you want. Click on 'back previous' button to correct any wrong information.

![E-TIN Registration Made Easy: Know How [Tutorial] 5 E TIN-8](https://thedhakatimes.com/wp-content/uploads/2015/04/E-TIN-8-600x343.jpg)

After all, click on 'submit application' button. Then TIN number and certificate will be generated.

After all, click on the 'view certificate' button to see the TIN certificate. Then you will see the TIN certificate.

![E-TIN Registration Made Easy: Know How [Tutorial] 6 E TIN-10](https://thedhakatimes.com/wp-content/uploads/2015/04/E-TIN-10-600x574.jpg)

The details to be filled by the car payer can be seen here. A taxpayer can activate e-TIN by filling the above information step by step. Don't panic if the registration page doesn't open or if you have any problems. to solve the problem By clicking here get help Source: Courtesy of hifipublic.com.